BBVA was founded as the Central Bank and Trust in Birmingham in 1964. It is headquartered in the historic Daniel Building in downtown Birmingham Alabama. Though it had a humble beginning, the bank has grown into a very big institution over the years.

Currently, BBVA operates about 650 branches in Alabama, Colorado, New Mexico, Florida, Arizona, Texas, and California. Along with its own ATMs, BBVA is part of the Allpoint network, giving customers access to about 64,000 fee-free ATMs.

Most of the people living in the service areas love BBVA bank accounts mainly for strong online banking and stellar customer support. However, there is more to this bank than just these two qualities.

We offer you a rundown on everything you would want to learn about this bank to help you decide whether it will be a good fit for your banking needs.

But if you don’t find it good enough, we offer you alternatives at the end of the review.

Advantages of BBVA Bank

- Free and online checking account option

- Opening a checking and saving account only cost $25

- Cashback rewards on debit cards

- Highly rated mobile app

- Large ATM network

Disadvantages of BBVA Bank

- High overdraft fee

- Located only in 7 states

- Very low saving rates

- Low-interest rates

- Few monthly transactions without fees

BBVA Bank Quick Overview

Pros and Cons

Pros

- High mobile app ratings.

- Access to over 64,000 ATMs.

- Full service banking options

Cons

- Low rate for online savings.

- No interest in checking.

BBVA Bank Products Offered

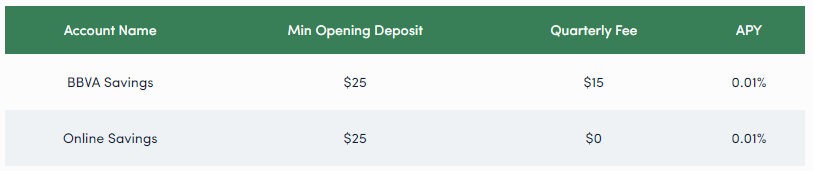

Savings Accounts

A BBVA savings account is a basic account with a lot of benefits. You only need a $25 minimum deposit to open the account and enjoy a 0.01% annual percentage yield (APY).

With this account, you are guaranteed 24/7 access to online and mobile banking, linking to your checking account for overdraft protection, and easy access to your money.

The bank levies a quarterly saving charge of $15 which can be waived. All you need is to maintain a minimum daily collected balance of $500 in your account. The easiest way to waive this quarterly fee is to set up an automatic monthly transfer of at least $25 from a BBVA checking account.

Online Savings Account

In addition to the standard BBVA savings account, the bank also offers an online savings account. BBVA online savings account isn’t much different from the standard savings account though. However, it doesn’t have quarterly maintenance fees.

The rest of the features such as 0.01% APY, $25 minimum deposit among others remain the same.

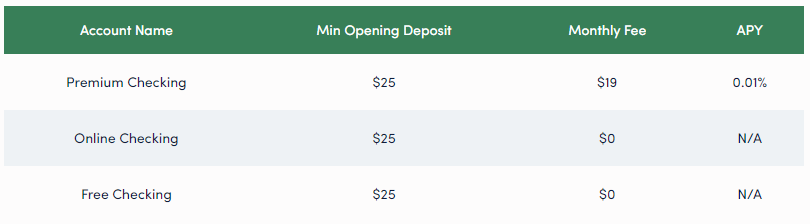

Checking Accounts

BBVA offers various checking accounts including:

Premium Checking Account

The bank premium checking account is the only interest-bearing checking option earning 0.01% APY. It charges $19 monthly maintenance fees for this account. However, you can easily waive it by maintaining at least $4,000 or making more than $4,000 in direct deposits every month.

Other extra features include:

- Free ATM access at 64,000+ BBVA, Allpoint, and participating 7-Eleven ATMs

- automatic rebate of two out-of-network ATM fees a month

- Personalized debit cards are available

- $25 minimum opening deposit

Online Checking Account

BBVA online checking account can also be opened with an initial deposit of $25 just like the rest of the accounts offered by this bank. The online checking account will offer you a free BBVA Visa debit card – one per account holder. Customers also earn cashback rewards for qualifying purchases using a BBVA debit card.

Other features include:

No monthly maintenance fee

Access to 64,000 BBVA, AllPoint, and 7-Eleven ATMs across the U.S.

Free Checking Accounts

This is a basic account with several free perks including no ATM fee at BBVA, no monthly maintenance fees, free Visa debit card, and more.

However, opening account charges remain the same – a $25 minimum deposit just like other BBVA accounts. In addition to account opening charges, there are several other perks that come at a cost, including:

- Unlimited cashier’s checks for $2 per month

- Safe-deposit box for $3 per month

- An option to personalize a debit card with a photo for a $10 fee

- Unlimited standard checks for $2 per month

- No BBVA fees for using another bank’s ATM and four ATM fee rebates for $5 per month

Easy Checking Account

An easy checking account is an alternative if your banks and credit unions won’t let you open a checking account because of problems in your financial history. The account has a monthly fee of $13.95 which cannot be waived.

Its biggest strength is that it offers access to a brick-and-mortar checking account. Even more, you can potentially upgrade to a more affordable account after 12 months.

Money Market Accounts

You can open a BBVA money market account with only a $25 deposit. The bank charges $15 monthly maintenance fees that can be waived by keeping a daily minimum balance of $10,000 or setting up an automatic monthly transfer of at least $25 from a BBVA checking account.

Its APY of 0.01% is also similar to the other accounts we have discussed above. Rates are tiered based on the daily balance which may change depending on where you reside.

Certificates of Deposit

This is a timed deposit saving account of typically one to three years during which you can earn a fixed rate of interest. During the term, you do not have access to your money until it reaches maturity – at the end of the term. If you withdraw money prior to maturity you will get penalized.

With a CD from BBVA, you will enjoy a risk-free rate of returns on your investment. CDs are FDIC-insured up to the applicable limit and therefore you are guaranteed a rate without a risk.

The rates are as follows:

- 11 month CD = 0.05% APY

- 12 month CD = 0.05% APY

- 18 month CD = 0.05% APY

- 36 month CD = 0.05% APY

These rates are for CDs opened online. To learn the rates and the terms offered for the CDs opened at your local branch call 1-844-BBVA the USA or your local branch.

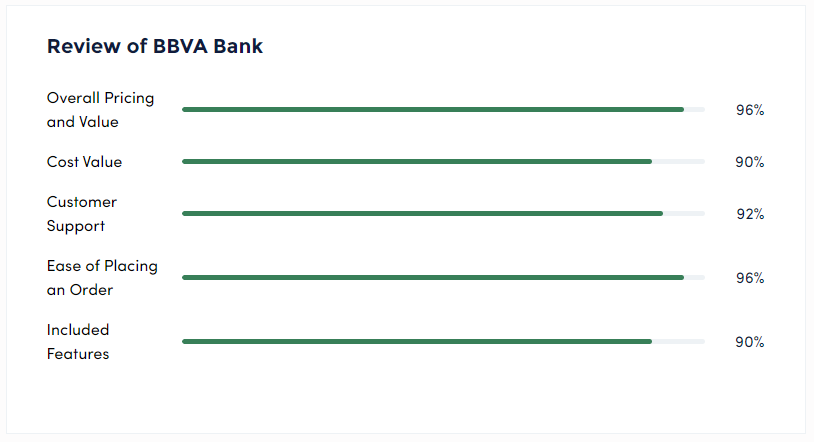

BBVA Bank Service Review

Other qualities of BBVA bank include the following:

Banking experience

BBVA has a user-friendly website. The website does a good job of highlighting its various accounts and fees. The website also offers a guideline on how you can avoid these fees.

The bank mobile app boasts a great review among users. It is easy to use and will save you a lot of transaction time.

Locations And ATMS

Unfortunately, you will not come across BBVA branches so often as you would with big banks. Though it boasts 650 branches, you can only find them in 7 states as of now. These states include Florida, Alabama, California, Arizona, New Mexico, Colorado, and Texas.

However, their ATM access is well advanced. In addition to its own ATMs, BBVA is part of the Allpoint network, giving customers access to about 64,000 fee-free ATMs.

Customer Service

At BBVA, customer service comes first. The bank offers several ways you can use to reach out to them. In their customer service section, you will find different phone numbers that you can choose depending on where you live or the service that you want.

If you are looking to open an account in Colorado, Florida, Alabama, Arizona, New Mexico, and Texas, you can contact them via 1-844-228-2872. For other states, you can call 1-866-534-4482.

For debit cards, you can contact customer care immediately at 1-844-BBVA USA. Anything to do with a credit card, call 1-800-239-5175.

Apart from phone contact, you can also reach out to the customer support team via email, Twitter, direct chat, or raise your queries via the FAQ section. If you live near a branch, you can visit it in person and raise your queries.

How to Bank With BBVA

Opening a bank account with BBVA can be done online at BBVAUSA.com or at a branch near you. As of now, the website will direct you to PNC as with most financial institutions.

The good thing is, the bank doesn’t have stringent requirements when opening an account. You only need to verify your identity by offering information from either of the following sources:

- Driver’s license

- Passport

- State-issued ID with photo

Opening a new account requires a deposit from an existing BBVA account, a debit or credit card, or an account at another bank.

Who Is BBVA Bank Best For?

If you are looking for a full-service online bank, this can be the best choice. It may be a good option if you are looking for a bank that will enable you to:

- Access a large no-fee ATM network

- Have several accounts at the same time

- Do most of your banking online or via phone

This bank will also be great if you don’t mind keeping a large account balance to avoid monthly fees. In addition, it won’t a great choice if you are interested in earning interest from savings or checking accounts.

BBVA USA guarantees great banking, great customer support, and convenient ATM access. For those who live in service areas, this is a great physical bank with a free checking option.

The bank offers checking accounts, money market accounts, savings accounts, credit cards, personal loans, auto loans, home equity lines of credit, business banking, financial planning, and wealth management.

However, the bank has its limitations as well. To begin with, it limited to a few states, low-interest rates, and requires maintaining a large account balance to avoid monthly fee charges. If these drawbacks are enough to get you switched off, here are the alternative

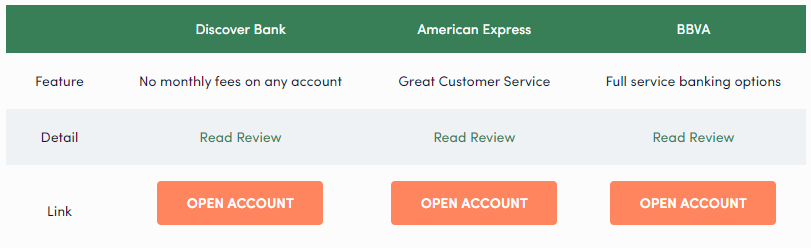

2 Top Bank of BBVA Bank

Discover Bank Online Savings

Founded in 1911, Discover bank has remained the number one choice to many. Most of its online accounts do not have monthly fees. Discover online savings account offers online checking accounts and CDs for free. The only account that isn’t free is the money market account that will start charging if your balance falls below $2,500.

American Express® High Yield Savings Account

American Express® High Yield Savings Account offers easy access to your money at a high-interest rate. You start earning interest with any amount you deposit into your savings account but the more you deposit the more interest you earn.

No minimum requirement, no monthly fees, and superior customer service are some of the other benefits this account offers.

Conclusion

No minimum requirement, no monthly fees, and superior customer service are some of the other benefits this account offers.

Frequently Asked Questions (FAQs)

Is BBVA a good bank?

BBVA offers a good banking experience, convenient ATM, and great customer service. If you are looking for the best physical bank with a free checking option, it is safe to consider BBVA.

Is BBVA insured?

BBVA a member of the FDIC, meaning, your deposits insured up to the Federal maximum. The Federal maximum is currently at $250,000 per depositor, per bank.

Does BBVA have a money market account?

A BBVA money market account requires a low initial deposit just like BBVA savings accounts and a monthly service charge that’s easy to waive if you maintain an average daily collected balance. The account also has an APY rate of 0.01% like other BBVA accounts.

Does BBVA have monthly fees?

Most BBVA accounts come with monthly fees that can waived. However, using a BBVA U.S.A. to complete any transaction is free.

Does BBVA charge for transfers?

BBVA charges transfer fees for use of their services. This transfer fee is subject to change and it changes without notice. To know the fee schedule in this agreement for the current amount of transfer fee, you can call their customer service at 1-800-273-1057.